Highlights

- Hy-Conn walked into Shark Tank, asking $500,000 for 40% of the business, with an implied valuation of $1.25 million.

- Jeff Stroope accepted a deal from Mark Cuban: $1.25 million for 100% ownership of Hy-Conn, along with a three-year employment contract at $100,000 per year and a 7.5% royalty on future sales

- The deal with Mark Cuban failed after the show, and the company continued operating independently with mixed results.

The Shark Tank is often seen as a launching pad for inventors and entrepreneurs, and this was the dream for firefighter Jeff Stroope when he pitched Hy-conn on the Tank.

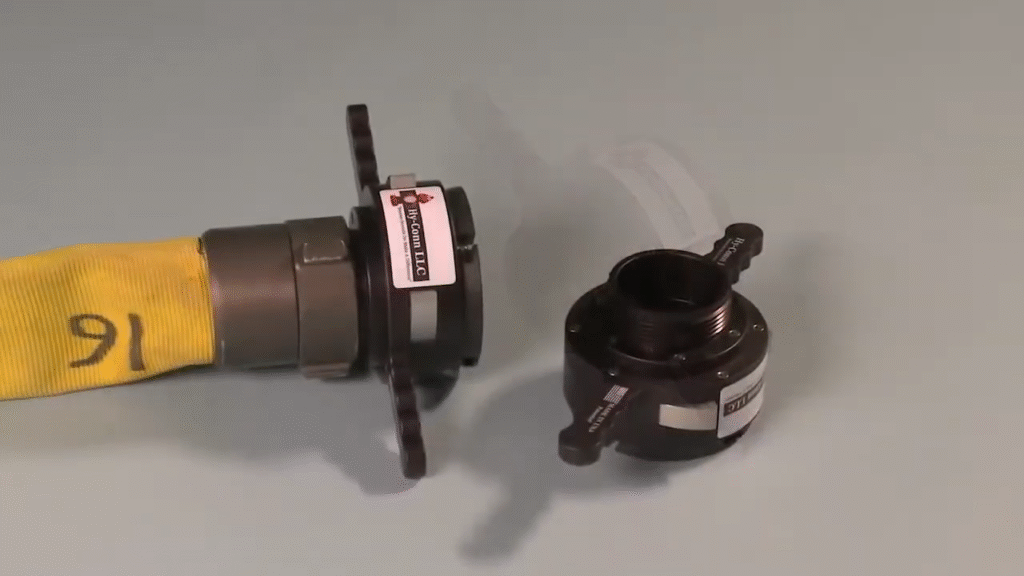

Jeff hoped to get one of the Sharks to invest in his quick-connect device for fire hydrants and garden hoses, which captured the Shark’s attention immediately.

The quick-connect device promised faster connections in emergencies, unlike conventional devices, which take time to connect.

While Jeff expected his fire hydrant device to land a deal, it was the garden hose device that created a buzz, with the Sharks competing to buy him out.

Let’s explore what happened to Hy-Conn after Shark Tank.

Hy-Conn Overview

| Field | Detail |

|---|---|

| Company name | Hy-Conn (Hy-Conn LLC) |

| Founder name | Jeff Stroope |

| Industry | Firefighting/ emergency equipment & hose/connectors |

| Product name | Hy-Conn quick-connect adapter for hydrants/hoses |

| Asking | $500,000 |

| Equity offered (at time) | 40% |

| Valuation implied | $1.25 million |

| Result | Deal offered (but ultimately not closed) |

| Shark with a deal | Mark Cuban (offered $1.25 million for 100%) |

Net Worth: How much is Hy-Conn worth today?

Hy-Conn LLC has an estimated net worth of about $5 million, higher than the implied valuation of $1.25 when the company appeared on Shark Tank. This valuation is based on the company’s real assets, patents, and speculative goodwill.

Some sources claim that the company is not fully operational, but its websites are up, and there seems to be minimal activity.

Hy-Conn Shark Tank Pitch

When Jeff Stroope, a former firefighter and inventor, walked into Shark Tank, he brought a compelling real-world problem: connecting fire hoses to hydrants is time-consuming and cumbersome in emergencies.

- The Hy-Conn device aimed to solve this problem by introducing a quick-connect mechanism that can drastically reduce the connection time and delay in firefighting efforts.

- Jeff demonstrated how traditional connections require alignment, threads, and often result in leaks, which his quick-connect system would snap in quickly and with minimal fiddling.

- Jeff revealed he had purchase orders from fire departments, plus he was also preparing paperwork for some orders.

- He revealed that the small connectors retail for $215 while larger hydrant adapters cost around $385.

- Daymond John backed out, saying the distributors’ hesitation showed they didn’t fully believe in the product.

- Barbara Corcoran also went out, doubting that fire departments would have the budget to buy it.

- Robert Herjavec questioned why Jeff wasn’t focusing on regular garden hoses; Jeff showed a prototype and said he prioritized fire departments first.

- The garden hose prototype sparked a Shark fight, with Kevin and Mark Cuban competing to get full ownership of part or all of the company.

Keep reading to know whether Jeff walked out with a deal, and how Hy-Conn is doing today.

Did Hy-Conn Get a Deal on Shark Tank?

- Mark Cuban liked the garden hose idea and offered $1.25 million for 100% of the company, plus a 3-year job at $100,000/year and a profit-sharing component.

- Kevin O’Leary countered with $500,000 for 100% of the garden hose connectors and a 5% royalty in perpetuity.

- Robert went out after Jeff said he’d prefer a 7.5% royalty, calling it too generous.

- Kevin refused to change his offer, but Mark matched Jeff’s request by adding the 7.5% royalty to his deal.

- Jeff Stroope ultimately accepted Mark Cuban’s offer of $1.25 million for 100% ownership, a three-year employment agreement at $100,000 per year, and a 7.5% royalty on future profits.

What happened to Hy-Conn after Shark Tank

After Shark Tank, there are disagreements between Mark Cuban and Jeff Stroope around licensing, manufacturing control, and the company’s direction. These disputes resulted in the deal falling through. Ultimately, while a deal was agreed verbally, the deal with Mark Cuban collapsed.

With Hy-Conn on its own, it continued to grow independently, taking advantage of Shark Tank publicity to grow its business. Here are some notable Hy-Conn developments after Shark Tank:

- Partnership & manufacturing efforts: Stroope reportedly teamed up with 101 Ventures to try to resume manufacturing and distribution.

- Conferences/trade shows: Hy-Conn made appearances at events like the Fire Department Instructors Conference, using those platforms to market the device to fire-service professionals and networks.

- Wholesale/distributor push: The company reintroduced a wholesale program via its site, where retailers or specialty businesses could apply, get approved, and access promotional support, pricing, and logistics.

- Operational challenges: Hy-Conn faced difficulties scaling manufacturing, cost pressures, licensing constraints, and the niche nature of the firefighting equipment market as obstacles.

Is Hy-Conn still in business?

Hy-Conn appears to have an operational footprint, with its website and product listing active.

However, it seems to have limited activity compared to what you would expect from a fully active and growing company. It is uncertain whether its products are still available for purchase since sales are not documented.

So, Hy-Conn is still in business but in a minimal capacity, but it is not operating as a thriving enterprise at present.

Conclusion

Jeff Stroope’s Shark Tank appearance secured headline popularity and an impressive on-stage offer from one of the wealthiest Sharks, Mark Cuban.

But like most Shark Tank deals, winning a deal on TV is just the start. When it comes to negotiating the details of licensing and manufacturing, the early promises can change, and this is what happened to Hy-Conn- the deal never closed.

After the show, Hy-Conn persisted. It sought partnerships, re-entered trade shows, introduced wholesale programs, and maintained a modest presence in firefighting circles. But the company’s trajectory has been uneven: there’s no clear, robust public record of booming growth or major contracts.

Related Posts: